| Introduced: | May 1983 |

| Price: | US $3995 |

| Weight: | 9 pounds |

| CPU: | Intel 8088 @ 5 MHz |

| RAM: | 32K built-in |

| Display: | LCD - 66 X 8 text 400 X 64 pixels |

| Interface: | standard keyboard touch-pad "mouse" |

| Ports: | video, serial, modem |

| Peripherals | optional printer |

| Storage: | Internal 3.5-inch floppy |

| OS: | Gavilan OS MS-DOS 2. |

--------------------------

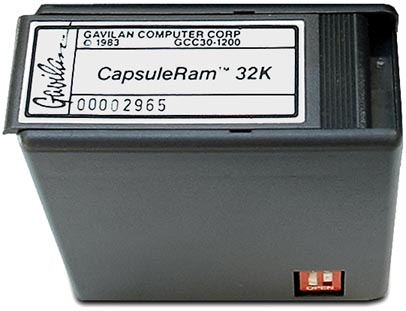

The Gavilan SC has space for up to four 32K plug-in capsules of battery-backed RAM ($350 each), or applications software packages.

-------------------------------------

-------------------------------------

October 1984 (NEWS PAPER) The Gavilan Computer Corporation, a closely held manufacturer of lap-model personal computers, said that it filed for protection under Chapter 11 of the Federal bankruptcy laws in San Jose, Calif.

The company, which a year ago began marketing a portable computer that drew acclaim throughout the industry, ran into several delays in introducing new models. The company also suffered from slow sales of lightweight lap computers, and encountered heavy competition from a number of other manufacturers. Gavilan officials said last week that efforts to sell the company had failed, and that all but about two dozen employees had been dismissed.

--------------------

Manuel Fernandez is the chairman and CEO of the Gartner Group, based in Stamford, Conn., a high-tech consulting firm that generated $511 million in revenues last year. He reflects upon his biggest business mistake.

(Like everybody else, I have made a lot of mistakes. But we all learn from our mistakes -- sometimes even more than we do from our successes. I made my biggest mistake when I was starting my first computer company, Gavilan, in the early 1980s. I didn't understand how important it was to have cash -- and I learned, the hard way, to regret that.

With Gavilan we had a brilliant business opportunity on our hands. By 1982 we had developed the first true battery-powered laptop computer -- years ahead of its time. We received lots of acclaim when we introduced our product, and we were sure of our success.

I hadn't counted on one crucial thing: cash-flow problems. To start Gavilan we had raised $30 million in capital. We had the opportunity to raise as much as $60 million, but my cofounders and I were intent on trying to hold on to the equity of the company. So we stopped at $30 million. Unfortunately, we didn't anticipate how much cash we'd need as we were developing our new product. Things can and do go wrong. For example, the manufacturer of the disk drives for our laptops went out of business. There had been only one company equipped to manufacture the disk drives, so we had to delay production until we could find a second manufacturer. Then, once we did, we had to spend another few months redesigning the disk drive so that the manufacturer could make it.

We literally ran out of money. By April 1983 we were in Chapter 11.

Cash flow isn't an area that many entrepreneurs are thinking about when they start companies. We're obsessed with revenues and profits and trying to hold on to the equity. But since then, I have always insisted that our company be debt free -- and that we have prudent cash flow. Now we look at it every single day.)

0 comments:

Post a Comment